Dividend For Apple Stock

Dividend For Apple Stock - Apple's dividend has become a hot topic among investors in recent years. With the company's massive cash reserves, many are wondering what the future holds for its dividend payments. In this article, we'll take a look at some of the data surrounding Apple's dividend and what it could mean for investors in the next five years.

What Will Apple's Dividend Be in 5 Years?

The Motley Fool

According to data from The Motley Fool, it's possible that Apple's dividend could increase significantly in the next five years. The company has been steadily increasing its dividend payments over the past decade, and with its massive cash reserves, it's likely that this trend will continue. In fact, The Motley Fool predicts that Apple's dividend could increase by 75% or more by 2026.

According to data from The Motley Fool, it's possible that Apple's dividend could increase significantly in the next five years. The company has been steadily increasing its dividend payments over the past decade, and with its massive cash reserves, it's likely that this trend will continue. In fact, The Motley Fool predicts that Apple's dividend could increase by 75% or more by 2026.

Apple's Dividend Yield is Up More than 50%

Philip Elmer-DeWitt

Another piece of data to consider is Apple's current dividend yield. As of June 2021, the company's dividend yield is just over 0.7%. While this may not seem like much, it's worth noting that this is more than 50% higher than it was just a few years ago. This indicates that Apple is making a conscious effort to reward its shareholders with dividends.

Another piece of data to consider is Apple's current dividend yield. As of June 2021, the company's dividend yield is just over 0.7%. While this may not seem like much, it's worth noting that this is more than 50% higher than it was just a few years ago. This indicates that Apple is making a conscious effort to reward its shareholders with dividends.

The Dividend Investor's Guide to Apple Stock

Kiplinger

Does Apple Pay a Dividend on Its Stock?

Stocks Walls

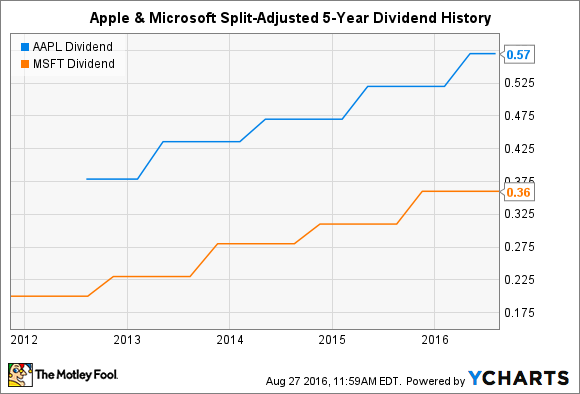

Yes, Apple does pay a dividend on its stock. The company first started paying a dividend in 2012 and has been steadily increasing the amount ever since. As of June 2021, the company's quarterly dividend is $0.22 per share. If you're a long-term investor, it's worth considering the potential income stream that Apple's dividend payments can provide.

Yes, Apple does pay a dividend on its stock. The company first started paying a dividend in 2012 and has been steadily increasing the amount ever since. As of June 2021, the company's quarterly dividend is $0.22 per share. If you're a long-term investor, it's worth considering the potential income stream that Apple's dividend payments can provide.

The Definitive Guide to Apple Stock Dividends

The Motley Fool

The Motley Fool provides another comprehensive guide to investing in Apple stock for the dividends. This guide includes information on Apple's dividend history, yield, payout ratio, and growth rate. Additionally, it offers some tips on how to make the most of your investment, including reinvesting your dividends and holding onto the stock for the long term.

The Motley Fool provides another comprehensive guide to investing in Apple stock for the dividends. This guide includes information on Apple's dividend history, yield, payout ratio, and growth rate. Additionally, it offers some tips on how to make the most of your investment, including reinvesting your dividends and holding onto the stock for the long term.

Tips for Investing in Apple Stock for Dividends

Now that we've looked at some of the data surrounding Apple's dividend, let's take a look at some tips for investors interested in investing in Apple stock for the dividend payments.

Consider Your Investment Goals

Before investing in any stock, it's essential to consider your investment goals. If you're looking for steady income, dividend stocks like Apple may be an excellent choice. However, if you're looking for capital gains or short-term profits, you may want to consider other investment options.

Monitor Apple's Financial Health

While Apple has a significant cash reserve, it's still essential to monitor the company's financial health. If the company's financial situation deteriorates, it could impact its ability to continue paying dividends. Investors should keep an eye on the company's financial statements and earnings reports to stay informed about any potential risks.

Reinvest Dividends

One way to maximize your returns is to reinvest your dividends. By reinvesting, you can purchase additional shares of stock, which can compound your earnings over time. Many brokers offer automatic reinvestment plans, which can make the reinvestment process easy and hassle-free.

Hold Onto the Stock for the Long Term

Finally, it's essential to keep a long-term perspective when investing in Apple stock for the dividends. While dividend payments can provide an income stream, the real benefits come from holding onto the stock for an extended period. Over time, the company's stock price will likely appreciate, providing investors with additional returns.

In conclusion, Apple's dividend is a significant consideration for investors interested in the company's stock. With its massive cash reserves and steady dividend payments, the company could be an excellent choice for investors looking for steady income. However, investors should consider their investment goals, monitor the company's financial health, and reinvest dividends to maximize their returns. By taking a long-term perspective, investors can potentially reap significant rewards from investing in Apple's stock for the dividends.

Find more articles about Dividend For Apple Stock

Post a Comment for "Dividend For Apple Stock"